Innov8rs Connect Unconference 2021: ESG Investing Takes Off in Southeast Asia

Gobi Partners say investors and entrepreneurs cannot afford to lose out on ESG investment.

Governments, companies, and investors are seeking new tools to counter unprecedented issues such as environmental catastrophes and political unrest. One of the much talked about tools today is ESG or Environmental, Social, and Governance practices.

Paul Ark, ESG & Sustainability Advisor to pan-Asian venture capital firm Gobi Partners hosts a special session, “ESG Investing Takes Off in Southeast Asia” as part of Innov8rs Connect Unconference 2021. Together with Techsauce CEO Oranuch Lerdsuwankij and Techsauce Global Content Editor Chaowarat Yongjiranon, Ark lays out clear and concise definitions of ESG, talks about the ESG investment landscape in Southeast Asia, and shares a case study from Gobi Partner’s own experience in applying ESG to its own VC investment activity.

Being Prepared for the Black Swans

The COVID-19 pandemic is proof that it is impossible for businesses to predict every black swan that might come its way. Black swans are unpredictable or unforeseeable events that bring about extreme consequences such as earthquakes, pandemics or social unrest. With the increasing number of these anomaly events, the question is whether or not they are connected in any way to human behaviors. If humans cannot predict when a disaster will occur, can we still be prepared for them?

Ark says, “yes”. He believes ESG (Environmental, Social, and Governance) is the right tool for investors and entrepreneurs at this time to manage these anomaly risks. ESG unlike what most may think, should not be confused with impact as it mitigates risk rather, than creates more value for a company.

There are three factors of the ESG framework in approaching risk. The first, environmental risk is how a company acts toward the planet. Second, social risk is how a company treats its employees, customers, suppliers, and local communities. Lastly, government risk involves how a company is run in terms of audits and shareholder rights.

Ultimately companies need to decide what side of the sustainable spectrum they will fit into. From traditional/financial investing to socially-responsible investing, to impact investing, companies need to strike a balance. Companies need to choose whether they will lean toward being returns driven, or impact driven. They also need to strike a balance between risk mitigation(ESG) and value creation (impact).

Asia is the New ESG Frontier

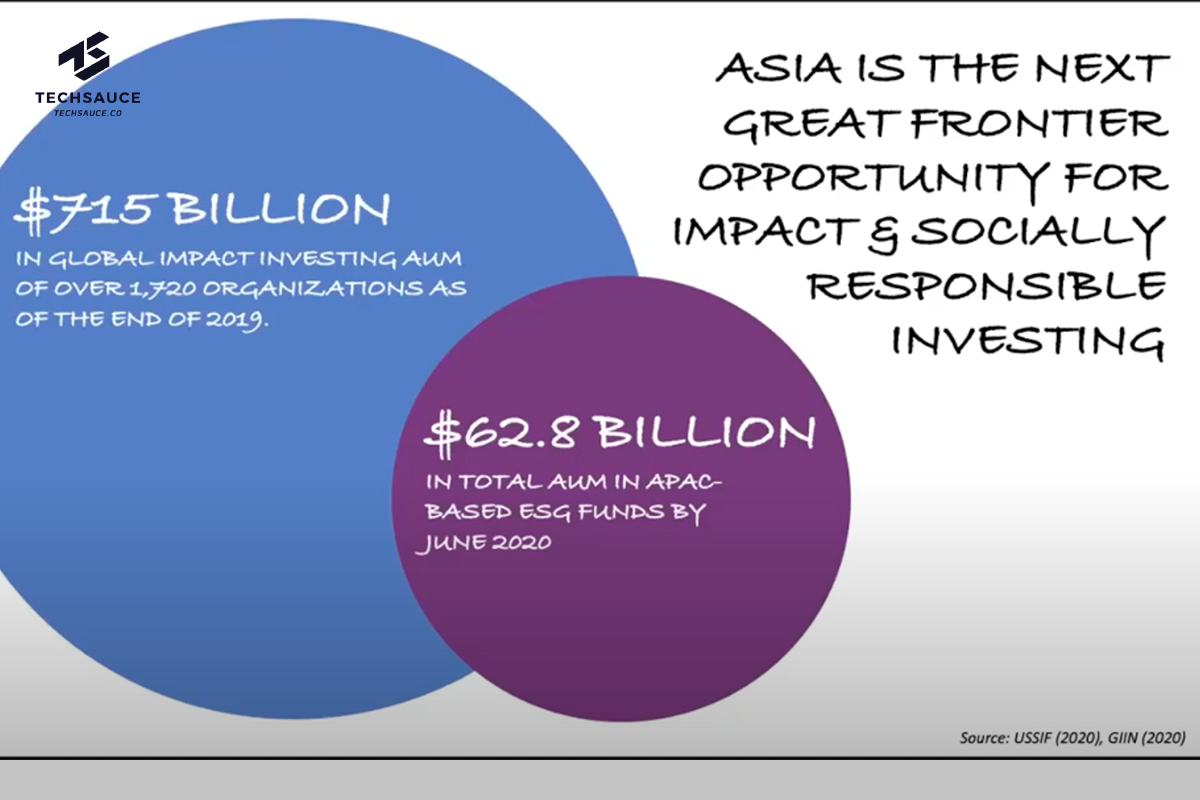

Ark believes Asia is the next great frontier opportunity for impact and socially responsible investing as out of the total global impact investment of US$715 billion in 2019, APAC-based ESG funds only represented 3% of that investment in June 2020. According to the BlackRock and Global Sustainability Survey, assets under management allocated to ESG, sustainability or impact investment for APAC is expected to double in the next five years to 20%. Therefore cooperates and especially early stage startups need to think of the future direction of portfolio investment.

The Lessons Learnt and Challenges for ESG

Overall ESG is expected to outgrow its niche status and become a mainstream issue as companies realize they will fall behind if they do not prepare to deal with emerging risk factors. ESG compliance also determines access to capital.

There are challenges ahead for ESG as there is limited understanding of it, standards for ESG reporting continue to evolve around the world, there is lack of resources and expertise to implement ESG practices, and companies need to tread carefully when it comes to publicity versus results.

Gobi Partners Spreading the Seeds for ESG Growth in Asia

With 13 funds under management valued at US$1.2 billion in 13 locations across the world, Gobi Partners has a portfolio of 270 companies. Over the past years the company has dedicated both capital and financial resources to support ESG growth in Asia. Partnerships were made with impactful organizations such as the United Nations and the Word Economic Forum.

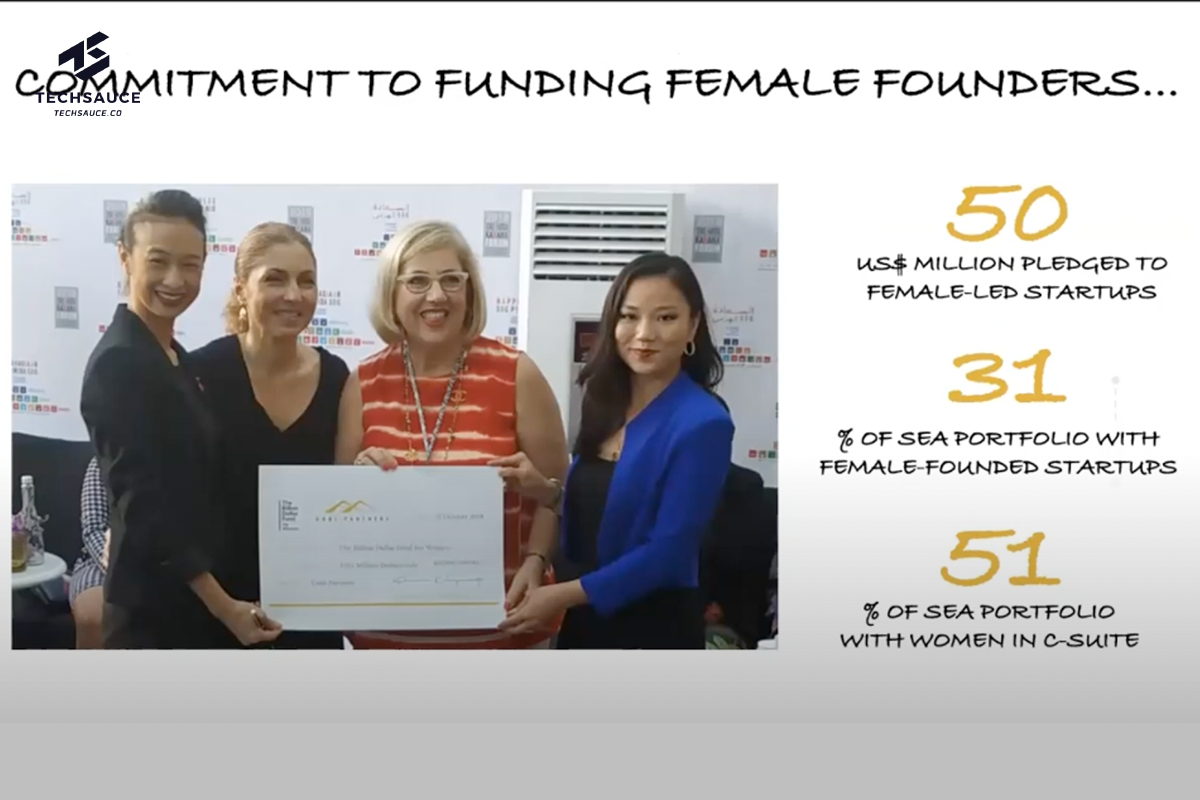

A good example of an ESG project delves into social impact with Gobi Partners pledging US$50 million to female-led startups, making 31% of its southeast asian portfolio founded by females. 51% of the region’s portfolio is with women in c-suite positions. The result had been measurable impact as surveys showed startups with diverse teams slightly gaining an increase in revenue growth and significantly being able to retain talent when compared to all-male startups. Diverse teams were found to be able to also have higher levels of prone fundraising when compared to all-male teams.

Find out more about ESG

For more information on ESG and other future trends for companies, you can check out the Techsauce or Gobi Partners websites.

Sign in to read unlimited free articles

.png)