East Ventures consistently races in the perfect storm: 2023 Recap & 2024 Outlook

In the face of a "perfect storm" of crises encompassing global economic uncertainty, sluggish valuations, inflationary pressures, and the specter of a potential recession, East Ventures foresees a thriving digital economy in Southeast Asia during the next economic recovery cycle. The company remains a staunch supporter of portfolio companies, founder investments, and the creation of meaningful ecosystem impacts, prioritizing adaptable drivers and collaborative teamwork.

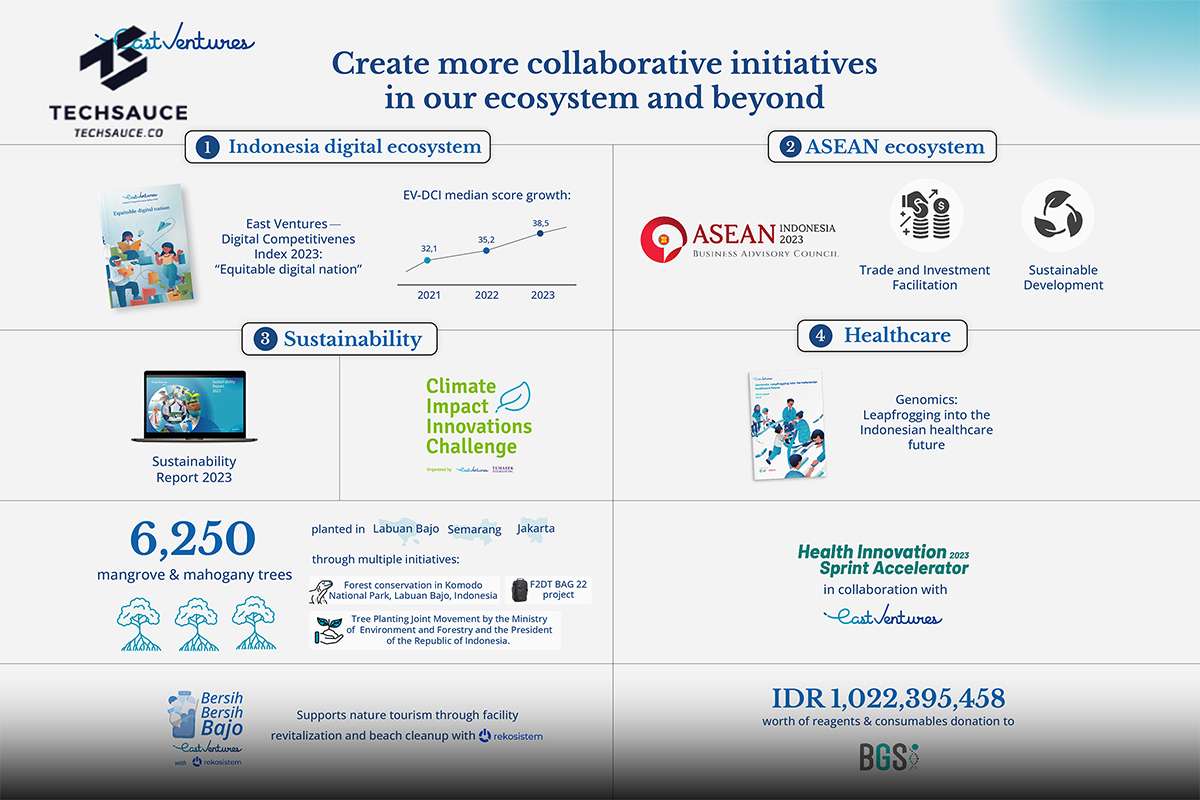

East Ventures has been actively providing substantial support and advice to founders, aiding them in navigating challenging times. Within its portfolio, 30% of growth-stage startups are on the path to profitability, 60% are already profitable, and 10% are adapting, underscoring the company's commitment to fostering resilient businesses.

Furthermore, East Ventures garnered strong support from Limited Partners (LPs) during fundraising, a clear vote of confidence in the investment strategy, leading to the successful sealing of three new funds last year.

In May 2023, East Ventures achieved a significant milestone by securing US$250 million through the successful launch of the first and final close of the Growth Plus fund. The fund aims to provide high-potential growth portfolio companies with the resources needed to scale.

Five months later, the company identified opportunities in building an investment corridor between the Southeast Asian and Korean venture ecosystems, culminating in the announcement of the “East Ventures South Korea fund in partnership with SV Investment,” totaling US$100 million. The fund is anticipated to have its first close in the first semester of 2024.

Most recently, East Ventures announced its inaugural US$30 million Healthcare fund dedicated to driving innovative healthcare solutions in Indonesia. The East Ventures Healthcare fund is poised to play a pivotal role in fostering and catalyzing healthcare innovation in Indonesia, showcasing the company's enduring commitment to the healthcare sector.

Collectively totaling US$380 million in multiple funds raised, these funds underscore East Ventures' robust commitment to diverse sectors, regional collaborations, and the vision of forging a productive and healthy Southeast Asia for current and future generations.

As an active player, East Ventures remains committed to investing in high-quality founders and maintaining a prudent approach. In 2023 alone, East Ventures sealed 63 deals, welcoming 29 new portfolio companies, and disbursing nearly US$80 million to their Seed and Growth portfolio companies. These strategic investments span various sectors, including e-commerce enablers, biotech, Software as a Service (SaaS), electric vehicles, climate tech, and more.

Infographic 1: East Ventures’ 2023 milestones snapshot

Infographic 1: East Ventures’ 2023 milestones snapshot

Consolidating the digital ecosystem and beyond

East Ventures continues to strengthen its presence within the digital ecosystem in Indonesia, the Southeast Asian region, and across broader sectors.

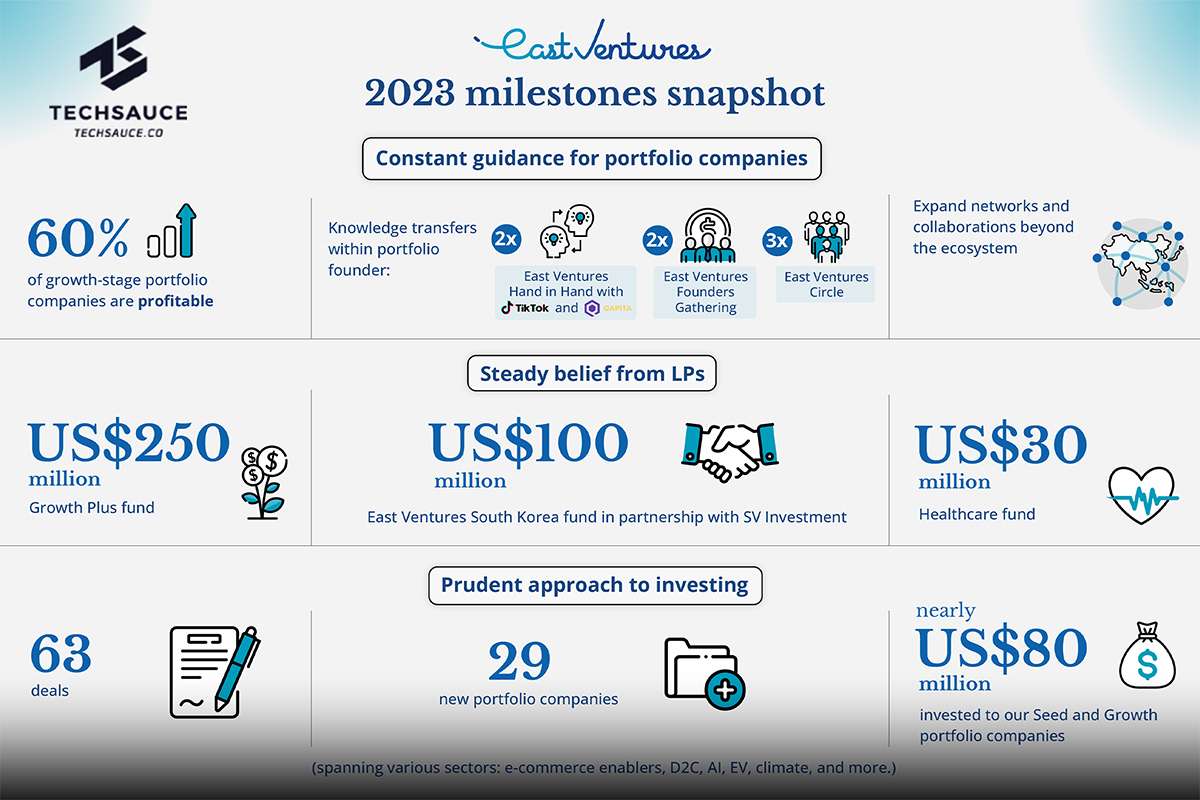

The commitment to advancing Indonesia's digital competitiveness has been reflected through various initiatives undertaken since its inception. Last year, the company launched the East Ventures – Digital Competitiveness Index 2023, the 4th edition since 2020. This report covers digital competitiveness across 38 provinces and 157 cities/districts in Indonesia, with a median score of 38.5. This marks a notable increase from previous years: 35.2 (2022) and 32.1 (2021). It’s evident that digital adoption has grown more equal across all provinces.

Additionally, the company remains optimistic about the resilience of the Southeast Asian economy. With a combined GDP of US$4 trillion, a population of 650 million, over 70 million small and medium-sized businesses, and a potential for a US$20 billion economic boost, the region presents enticing investment opportunities across countries. For instance, Indonesia and Thailand excel in automotive manufacturing. Their collaboration—Indonesia providing electric batteries and Thailand manufacturing automotive parts—can create a unified strategy, drawing significant investments to build a regional electric vehicle ecosystem.

Realizing the importance of an integrated ASEAN, East Ventures took part in promoting collaboration through the ASEAN-Business Advisory Council (ASEAN-BAC) 2023, which focuses on driving the region's transformation through innovation and inclusivity across priority programs, such as Digital Transformation, Sustainable Development, Health Resilience, Trade and Investment Facilitation, and Food Security. East Ventures engage proactively in two priority programs: Trade and Investment Facilitation and Sustainable Development.

These programs are fortified with legacy projects, aiming to ensure their enduring impact in the future. The Trade and Investment Facilitation programs address intra-regional trade disparities by reducing Non-Tariff Barriers, balancing trade with partners, and exploring upgrades to Free Trade Agreements. The ASEAN Business Entity (ABE) legacy project is designed to strengthen intra-ASEAN investment by offering advantages dedicated to promoting key reforms in trade and investment within ASEAN.

Aligned with the commitment to achieve net-zero emissions by 2050, East Ventures actively participates in the Carbon Centre of Excellence (CCOE), empowering ASEAN businesses to navigate carbon markets effectively and facilitating a common framework for the net-zero goal.

In 2023, East Ventures launched the second Sustainability Report, displaying proactive measures toward climate action. Additionally, the company initiated the first Climate Impact Innovations Challenge (CIIC) in collaboration with Temasek Foundation, Indonesia’s largest climate-tech pitching competition. This program received over 330 applications from Southeast Asia and beyond, with four champion companies chosen from four unique tracks: Renewable Energy, Food & Agriculture, Mobility, and Ocean.

East Ventures engages in impactful initiatives, fostering forest conservation and nature tourism in Komodo National Park, including 5,000 mangrove plantings, revitalizing tourist facilities, and the Bersih Bersih Bajo beach clean-up initiative in collaboration with Rekosistem, local government, and communities.

The F2DT BAG 22 project, a high-mobile backpack designed for founders on 2-day trips, empowers multi-stakeholders by enhancing internal team capabilities, collaborating with local SMEs, and partnering with local communities. From 250 F2DT BAG 22 sold, the company planted 1,250 mangrove trees at Semarang Mangrove Center, Central Java, Indonesia.

East Ventures donated 200 mahogany trees to help reduce air pollution in Jakarta for the Tree Planting Joint Movement (“Gerakan Tanam Pohon Bersama”), a collaborative project between the Ministry of Environment and Forestry and the President of the Republic of Indonesia. Through this movement, the company has donated 200 mahogany trees to help reduce air pollution in Jakarta.

Infographic 2: Create more collaborative initiatives in East Ventures’ ecosystem and beyond

Infographic 2: Create more collaborative initiatives in East Ventures’ ecosystem and beyond

In the healthcare sector, East Ventures undertook several initiatives, such as launching a white paper, “Genomics: Leapfrogging into the Indonesian healthcare future”, which was a collaboration with the Ministry of Health (MoH) of The Republic of Indonesia. This also led to the incubation program of MoH’s Digital Transformation Office, “Health Innovation Sprint Accelerator 2023 in collaboration with East Ventures”.

East Ventures continues to support the Biomedical & Genome Science Initiative (BGSi), which first commenced last year. In 2023, they donated reagents and consumables worth IDR 1,022,395,458 for use in sequencing processes in BGSi.

Cloudy but brighter skies, cautious paths

While the past few years have been challenging, East Ventures remains cautiously optimistic about the future. The potential loosening of the Federal Reserve's grip on interest rates in the United States could provide a boost to the tech industry, resembling a crack in the clouds revealing a patch of blue sky.

However, like seasoned racers, East Ventures' cautious instinct remains acutely aware of the obstacles ahead. Geopolitical tensions spread across certain regions continue to pose significant market volatility. Moreover, with essential elections in America and Indonesia approaching, the way forward still requires vigilance and unwavering focus.

As a skilled driver, East Ventures sustains its focus and self-awareness amidst the current situation. “Entering 2024 comes with uncertainties. Geopolitical tension in some countries and the instability of the global economy have led to substantial volatility. However, East Ventures see positive signs. We are staying aware, closely monitoring, and focused on our objectives regardless of external fluctuations,” said Roderick Purwana, Managing Partner at East Ventures.

Entering its 15th year in 2024, East Ventures reflects on its journey, having played a pivotal role in building Indonesia's digital ecosystem in 2009 when the potential of low internet penetration in Indonesia went unnoticed. With a massive population of over 270 million, predominantly in productive ages, Indonesia's digital economy has grown rapidly, with mobile phone penetration close to 80%, solidifying the country's status as an economic driver in ASEAN and Southeast Asia.

East Ventures' strategy remains firm: to identify and invest in the best founders and opportunities regardless of economic conditions. The company sees numerous investment prospects in diverse sectors, including climate, healthcare, and supply chains, pursuing sector-agnostic investments.

“East Ventures has demonstrated consistency and perseverance throughout our journey, through multiple funding cycles and global crises. The company constantly remind ourselves to compete with our previous achievements and stay alert for the less obvious opportunities. Our goal is to always be ahead of the wave before it becomes a mega-trend. As Indonesia is reaching an 80% internet penetration rate, East Ventures are witnessing the end of an era of consumer digital transition and the emergence of a new one: the upcoming demographic dividend bonus. In the next 10 years, Indonesia will enter an early demographic dividend era, leading up to the peak of the demographic dividend about 20 years from now. By then, almost 206 million people will be in the productive age, theoretically able to support their dependents. The majority of the workforce in the next 10 to 20 years will be digital natives, led by Generation Z and supported by a mature Millennial generation. A significant portion of the productive population is coming of age. These circumstances present a once-in-a-lifetime opportunity to transform Indonesia into a high-income country and catalyze the emergence of new business opportunities.Whether the upcoming generation will be able to realize the '2045 Golden Indonesia' vision or become a demographic liability depends on our readiness to prepare and act now,” Willson Cuaca, Founding Partner at East Ventures, concluded.

About East Ventures

East Ventures is a pioneering and leading sector-agnostic venture capital firm. Founded in 2009, East Ventures has transformed into a holistic platform that provides multi-stage investment, from Seed to Growth stage investments, for over 300 tech companies across Southeast Asia.

As an early believer in the startup ecosystem in Indonesia and the most active investor in Southeast Asia, East Ventures is an early backer of prominent tech companies in the region, such as Tokopedia, Traveloka, Ruangguru, ShopBack, Waresix, Xendit, IDN Media, KoinWorks, Sociolla, Tech in Asia (acquired by SPH), Kudo (acquired by Grab), Loket (acquired by Gojek), and MokaPOS (acquired by Gojek).

East Ventures was named the most consistent top-performing VC fund globally by Preqin and the most active investor in SEA and Indonesia by various media. Moreover, East Ventures is Indonesia's first venture capital firm to sign the Principles of Responsible Investment (PRI), supported by the United Nations (UN). East Ventures is committed to achieving sustainable development and positively impacting society through initiatives and ESG-embedded practices.

Sign in to read unlimited free articles

.jpg)

.png)